Contents:

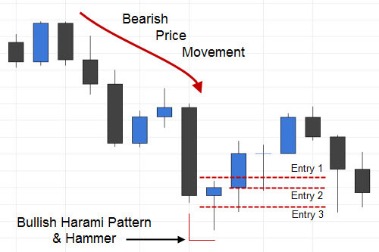

Secondly, price has retested a resistance level whilst in the downtrend. Then thirdly, we have a bearish engulfing candlestick for an entry confirmation. A bullish engulfing pattern is a candlestick formation that – according to technical traders at least –can predict an upcoming uptrend after a period of bearish sentiment.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

The higher the top and the lower the bottom of the engulfing candlestick’s body, the more powerful the pattern is. The best way that I have found to trade these patterns is to use them in combination with a break of a key level at a swing high. If you can also identify bearish price action on a retest of the broken level as new resistance, even better. Three outside up/down are patterns of three candlesticks on indicator charts that often signal a reversal in trend. Dark Cloud Cover is a bearish reversal candlestick pattern where a down candle opens higher but closes below the midpoint of the prior up candlestick. The pattern is also more reliable when it follows a clean move higher.

Isolate the Trend

Here is the same NZDUSD https://g-markets.net/, only this time we’re taking a blind entry on a 50% retracement measured from the high to the low of the engulfing candle. It’s okay if the body of the engulfing candle doesn’t engulf the previous candle. Only the range of the engulfing candle needs to engulf the previous candle to be considered a valid pattern. This can leave a trader with a very large stop loss if they opt to trade the pattern. Trading it competently involves adhering to prudent risk management principles. The engulfing bar can engulf more than one previous candle, but to be considered an engulfing bar at least 1 candle must be fully consumed.

Using these patterns as information going forward is a smart play if using a different type of trading strategy. If you look back at the last chart, you can see consolidations breaking to the downside. You can use the trend reversal as a sign to only look for support breaks from consolidation as long as the price pattern of lower highs and lows stays intact. Notice the near non-existent wick on the upper side of the bullish engulfing pattern – that is the side we expect the bar to break from. It also engulfs 11 bars prior to it – all the indications of a strong bar.

What do bullish engulfing candlesticks tell traders?

This gives a confirmation that the markets are looking to go lower. This gives a confirmation that the markets are looking to go higher. This is good if you want to increase your position size to take advantage of the continued strength behind the current trend.

You can also commonly find them reacting to support levels at an end of a trend. To identify an engulfing pattern you have to make sure that several things match up. Such as breaking news – you always see an engulfing pattern when the NFP is announced, it doesn’t mean you should trade it. The information does not represent an offer of, or solicitation for, a transaction in any investment product.

Identify a swing low

84% of retail investor accounts lose money when trading CFDs with this provider. Due to what the engulfing pattern signifies and should demoralize bulls, the failure of the highs of this candlestick would show at that point, it does not carry the weight we expect. You’d want to keep a fairly close stop and monitor for any momentum move against the reversal candle.

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-vQW4Fia8IM73qAYt.jpeg

They are very powerful, especially when they lead to a reversal of an uptrend. The candlestick trading indicator is usually classified into two main categories, Bullish and bearish to be precise. The efficacy of the patterns increase in presence of certain enforcing factors and alongside tech analysis patterns, support/resistance levels, and signals of trading indicators. Before trading for real, practice the patterns on a demo account.

This means that the top of the black candle’s body must be above the top of the white candle’s body, and its bottom must be below the bottom of the white candle’s body. When you get a strong price rejection at a key level, the market is likely to reverse lower. When you’re trading the Bearish Engulfing pattern, you don’t want to see a weak price rejection at a key level. So remember, if you want to trade price reversals, always look for a strong momentum move into a level. The next thing you know, the price does a 180-degree reversal at the highs and now this group of traders is “trapped”.

But with traditional trading, you buy the assets for the full amount. In the UK, there is no stamp duty on CFD trading, but there is when you buy stocks, for example. Looking at the recent price performance of GLD, it’s been on a downtrend since hitting a 19-month high of about $193 in early-March 2022. If the reversal is strong enough, the bulls that are running towards the exits and new bears stepping in, you can be up a significant amount of pips in a short time. Trading the lower time frame trend against the higher time frame trend, you may want to keep a slightly wider stop. While the lower time frame may be undergoing a complex correction, that may only be a simple correction on the higher time frame.

This is now a high probability trade, meaning the success rate is well above 50%. Now let’s add the key level so you can see how influential these patterns can be with the proper amount of confluence. The strategy you’re about to learn has three requirements to be considered a valid setup. Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California life, accident, and health insurance licensed agent, and CFA. She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans. However, the exact location will be relative to a bullish retracement in price, not the prevailing bearish trend.

On 7 September, GLD opened lower at $158.15 but rose 1% during the session to close at $159.94. The SPDR Gold Shares ETF tracks the performance of the price of gold bullion. It trades under the ticker ‘GLD’ and is one of the top ETFs in terms of assets under management in the world. The Average True Range indicator is a very popular trading indicator that can be used in many different trading situations. All services are free, so you to take advantage of the opportunities that Forex trading offers.

Once the pattern has been confirmed, a buy order can be placed a few pips above the green engulfing candle’s high. A stop-loss order can be placed a few pips below the lowest point of the pattern and a target order at a level where a previous high formed . Next, we will discuss a simple strategy to help you trade the engulfing forex pattern with the addition of a volume indicator to identify the highest-probability reversals. A Bullish Engulfing Pattern is a two-candlestick reversal pattern that forms when a small black candlestick is followed the next day by a large white candlestick, the body of which completely…

But first, with all candlestick patterns, they always tell you what is happening in the current market. A bullish engulfing pattern is when the pattern forms towards the end of a downward trend. Firstly, you have to ensure that the body of the engulfing bar overtakes the previous candlesticks. Many people in the market participated in the formation of the resulting reversal.

Related reading

In a down trending market, it is not uncommon to see the price action trend pattern of higher highs and lows as markets going through complex corrections giving you a short term up trend. We talked about large authoritative engulfing bars that engulf more than just the prior bar. As a general rule of thumb, we want our engulfing bars to stick out like sore thumbs on the chart. They are the most conspicuous when they are larger than previous bars and engulf multiple prior bars. The Engulfing Candlestick Pattern can be used on your trading platform charts to help filter potential trading signals as part of an overall trading strategy. The Engulfing Pattern can help us define the direction of the trend.

AUD/USD Forex Signal: Consolidation Pattern Continues – DailyForex.com

AUD/USD Forex Signal: Consolidation Pattern Continues.

Posted: Tue, 07 Mar 2023 08:00:00 GMT [source]

Not all how to trade bearish engulf forex bars are created equal and just because an engulfing bar has been formed, does not mean the trader should automatically enter the trade. A trader should not depend on a single metric to anticipate the price movement of an asset. Moreover, it is important to acknowledge that markets are unpredictable. Risk management tools like stop-losses can be used to minimise risk. Remember that your decision to trade or invest should depend on your risk tolerance, expertise in the market, portfolio size and goals.

The engulfing candle can be bullish or bearish depending on where it forms in relation to the existing trend. Whenever we stack factors and manage risk, we are well on our way to profitable trading and that is something we are able to do with the bullish engulfing candle pattern. In this example, the bullish engulfing pattern was strengthened by the fact that there was a key support level below at 1.2275, making this a multiple factor setup. After you’ve identified the swing high, it’s time to wait to see if the bearish engulfing pattern is formed. After you’ve identified the swing low, it’s time to wait to see if the bullish engulfing pattern is formed.

Read on to find out what the bullish and bearish hammers warn about. Such distribution of candles is called “Two crows” and signals a strong selling pressure. Once confirmed in a price chart, that’s a signal to open shorts.

Japanese candlestick charts took root in the ’80s and are incredibly popular with more serious traders. Glance into the complicated looking charts for the first time, and you may deem them difficult to understand. This doesn’t have to be the case — but if you’re starting from the very beginning, see this video on Candle Stick Analysis. In an uptrend, a reversal candlestick pattern called Bearish engulfing forms at the local highs of the chart.