Contents:

Not only this, but IEX also pioneered cross-border electricity globalization definition. The global asset manager purchased the company from Essel Group of Companies in August 2019. Later in mid-2020, Blackstone trimmed almost ⅓ of its stake to 51.91%. In addition to this, GMDC has a significant presence in the energy sector. It has a sizable portfolio of thermal power projects and also renewable energy projects .

Best stock discovery tool with +130 filters, built for fundamental analysis. Profitability, Growth, Valuation, Liquidity, and many more filters. Search Stocks Industry-wise, Export Data For Offline Analysis, Customizable Filters. I purchased 95% shares of Large cap with leader in their business. Really glad to know you are taking steps toward financial freedom. For the purpose of length, we keep our description to a maximum of 5 companies.

Infosys Limited provides consulting, technology, BPO Services, and top-notch digital services and is regarded as one of the top long-term penny stocks. The company’s FMCG portfolio includes brands such as Aashirvaad, Sunfeast, Bingo! The company is also the owner of several luxury hotels, including ITC Grand Chola in Chennai and ITC Maurya in New Delhi.

List Of Best Growth Stocks in India

Veterans can also leverage in-depth filters and pick from a massive range of international stocks. Pick a few financials, look at qualitative aspects like management quality, ethics, and CSR activities, and assess them based on historical information over three years or more. Tata Consultancy Services Limited is an Indian company that provides information technology services and digital and business solutions. The Company’s segments include Banking, Financial Services, Insurance, Manufacturing, Retail, Consumer Business, Communication, Media, Technology, Life Sciences and Healthcare, and Others. One can look at stocks like Reliance and HDFC Bank in the large caps and stocks like Polycab Ltd and Ashok Leyland Ltd in the mid cap space.

It is tough to name particular stocks as the best stocks to invest in India. Some stocks may be the best performing stocks at present, but due to market volatility and several other factors, they may not continue to be the best stocks to invest in India. This is to inform that, many instances were reported by general public where fraudsters are cheating general public by misusing our brand name Motilal Oswal. The fraudsters are luring the general public to transfer them money by falsely committing attractive brokerage / investment schemes of share market and/or Mutual Funds and/or personal loan facilities.

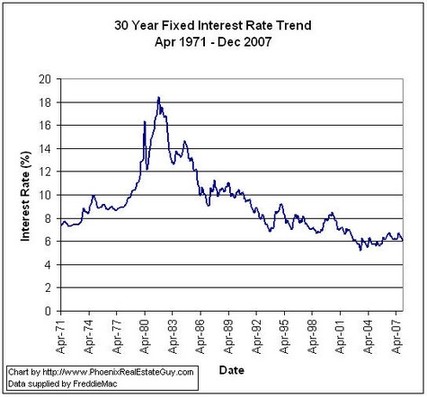

If you’re new to investing in the stock market, it can be overwhelming. Unlike a savings accounts, money market funds, and certificates of deposit, the stocks’ principal value fluctuates. Please note that investing in the stock market involves risks, and past performance is not necessarily indicative of future results. It’s important to do your own research and consider your individual financial situation before making any investment decisions. You need to study the trends of the stocks and analyse various considerations, before putting your money into a particular stock.

Top General Insurance Companies in India: Types, Differences, and More

There’s a great opportunity right in front of us and most ordinary investors have almost no clue about it. Ltd. can modify or alter the terms and conditions of the use of this service without any liability. It reserves the right to decide the criteria based on which customers would be allowed to avail of these services.

• Is the https://1investing.in/ being disrupted and how is the company placed for the disruption. For instance, in an oil company, you must avoid a company that is still obsessed with old fuels but rather look for companies that are into new fuels. Under the leadership of Amitabh Chaudhary, Axis Bank has focused on relationships, core government business, insurance franchise and made a big splurge on credit cards. The acquisition of the Indian consumer business of Citibank is likely to be value accretive for Axis Bank in adding high value clients to the roster. Amid recent optimism that inflation has peaked — and that the Federal Reserve could soon start to change its tone— 71% of respondents in a Bloomberg News survey expect equities to rise, versus 19% forecasting declines. For those seeing gains, the average response was a 10% return.

• The other mistake people often commit is to put money in stocks which they cannot risk for 3-5 years, at least. If you need the money back in 1 year, then equities are not the best place to be in. People often spend too much time waiting for a price bottom or a better price and in that process miss getting into the stock. The longer you are stuck to analysis, your investment decision gets delayed.

- For a stock to be in the top list, it has to have supportive macros, supportive industry level advantages and strong financial fundamentals and a set of intangibles.

- Furthermore, the Bollinger bands have opened with Higher Volumes suggest the rising volatility of the prices for an up move.

- As investments are subject to market risks and price fluctuation risk, there is no assurance or guarantee that the investment objectives shall be achieved.

- The formula for ROCE is EBIT/ (Total Assets – Current Liabilities).

Consumer preference for healthy & premium products is providing significant opportunity in this category. The company derives about 15% of its revenues from this segment which includes bread and other bread based products. An investor needs to assess the position of the company in the supply chain of its industry and whether it can generate enough returns between its inputs and outputs to fuel growth. In the most basic sense, value addition is the difference between the value of raw materials and the value of finished goods.

Stocks To Pick In 2023

“Nifty keNisaneBaaz”, “Nitin Ki PCR”, and “Nitin Option Wale” are some of his popular shows which are telecast in news channels such as Zee Business and CNBC Awaaz. Asian Paints is a classic example that embodies the true spirit of a ‘Forever Stock’. Had anyone invested Rs 500 in the company when it went public in 1982, the value of the holding would be as much as Rs 10 m today. These five penny stocks are enjoying multiple tailwinds and are set to grow exponentially in 2023. These companies are fundamentally strong and can ride out any storm.

My Top FAANG Stock to Buy for the Second Half of 2023 (and Beyond) – The Motley Fool

My Top FAANG Stock to Buy for the Second Half of 2023 (and Beyond).

Posted: Sat, 01 Apr 2023 07:00:00 GMT [source]

The brokerage house has shared fourteen stocks as its top picks for 2023 that investors can look to buy. The recommendations include Infosys, State Bank of India , ITC, L&T, Axis Bank, Maruti Suzuki, Titan, UltraTech Cement, Apollo Hospitals, PI Industries, Macrotech Developers , Indian Hotels, Bharat Forge, Westlife Foodworks. Expect ashok Leyland iam holding all the stocks you’ve mentioned under Rs 200,NMDC AND NALCO are also portfolio stocks under rs 200 ,which offer high dividend yield. Vikalp Mishra is a commerce graduate from the University of Delhi. He is a voracious reader with a genuine interest in investing. The list below lists more such companies with share prices less than Rs. 200.

Understanding G-Secs and How to Invest in Them for Business

The strategy behind long term investing is to hold on to stocks for a period of more than three years, or possibly more than five years. If you’re considering investing in large cap stocks, here’s an overview of some of the best ones that you can invest in in the year 2023. You get to enjoy a plethora of different benefits by investing in large cap stocks. In this article, we’re going to briefly take a look at what large cap stocks are, some of the advantages that you get to enjoy by investing in them, and 5 of the best large-cap stocks that you can invest in 2023. Volatility adds to the risk and hence reduces the valuation of the stock. From a trader’s or investor’s perspective, volatility means stop losses can get triggered faster.

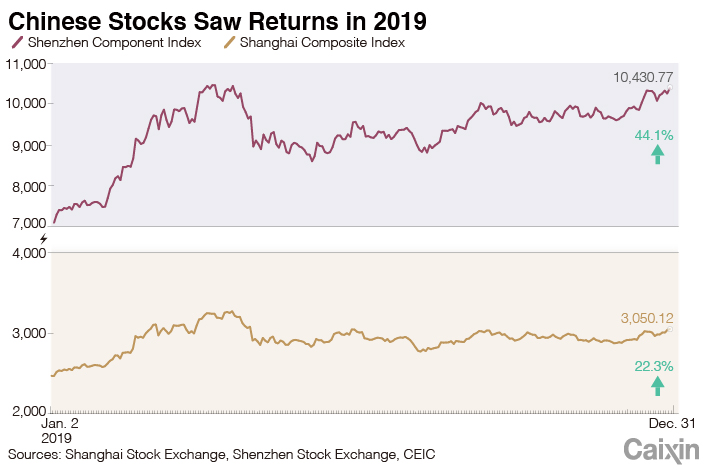

Evgenia Molotova, senior investment manager at Pictet Asset Management, said she would be a selective buyer of Chinese shares “at current levels,” preferring industrials, insurance and health care in China. Do not commit to a trade based on either technical or fundamental analysis only – multiple factors should converge in order to make an informed decision on any trade, especially if it is for the long term. It is focused on consulting and technology in finance, FMCG, telecom, healthcare etc.

- These are the top 5 large cap stocks that you can consider investing in this new year.

- On the back of strong earnings growth, its stock price has rallied 151% in the last year giving a multi-bagger return to its investors.

- The competitive advantage gives growth companies a unique selling proposition , which helps them sell and grow better than other companies within the same industry.

- The 20 days SMA is acting as a strong variable support for the prices, from where the trend recently has shown a bounce from.

A very popular argument is of comparing growth stocks vs value stocks as they exhibit completely different characteristics when being evaluated. As mentioned earlier, a growth stock is characterized by higher price multiples and valuations and low dividend payouts while exhibiting a stronger and more volatile momentum in the market. The stocks mentioned in this article are not recommendations.

In order to get an exposure to best stocks for the long term, you need a total of ₹ 86,938 for the below curated portfolio as of 21st Dec, 2022. The efficient handling of this balance indicates the strength of corporate governance. The higher and better the standards of corporate governance are, the better protected the minority shareholders of the company are and can be assured that the management will act for the benefit of shareholders.

In the small-cap space, mutual funds were seen selling stocks like MGL, SH Kelkar, IIFL Finance, Jagran Prakashan, Orient Cement, Quess Corp, Jindal Stainless, Stove Kraft, TCNS Clothing, and WPIL. These stocks belong to sectors such as finance, engineering, and media, indicating that mutual funds were looking to exit from some of these names which could be due to profit booking and also weakness in growth prospects as well. These stocks belong to sectors such as finance, engineering, and healthcare, indicating that mutual funds were looking to invest in sectors with potential for growth.

Best Long Term Stocks to Buy in India 2023

The top 100 companies in terms of market capitalization listed in the Indian stock market are known as large cap stocks. These stocks usually have a market capitalization of above Rs. 20,000 crores. One of the factors that set large cap companies apart from others is that they’re well established, possess a strong market share, and are financially very stable. Typically, companies offering such stocks do not pay dividends as they want to reinvest the earnings to accelerate the organisation’s growth. However, the anticipated capital gains investors earn while selling their shares in the future offsets the need for more passive cash flow. For a stock to be in the top list, it has to have supportive macros, supportive industry level advantages and strong financial fundamentals and a set of intangibles.

Thus going ahead, with accelerated push by Centre towards capex and expected revival in private investment along with peaking inflation, Nifty earnings are expected to remain robust and grow at 17% CAGR over FY22-24,” it added. Credit growth and capex and thus sectors like BFSI, capital goods, infrastructure, cement, housing, defence, railways could be in focus. Trade Brains is a Stock market analytics and education service platform in India with a mission to simplify stock market investing.

3 Best Stocks to Buy Now, 3/30/2023, According to Top Analysts – TipRanks

3 Best Stocks to Buy Now, 3/30/2023, According to Top Analysts.

Posted: Thu, 30 Mar 2023 07:00:00 GMT [source]

4) No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account. Large cap companies are typically well-established and have a long track record of financial performance, which can provide a level of stability for investors. In fact, it is about consistent performance, consistent growth in top line and bottom line as well as some unique moats that the company has created over time. In reality, it is about the best share to buy for long term and the best long term stocks.

Does reduced visibility in office impact appraisal and career growth

Multi-asset funds give your portfolio the firepower of equities, the stability of debt, and the hedge effect of gold/silver, thereby ensuring that you achieve optimal asset allocation simply by investing in a single fund. While it is good to have an idea of the stock prices of different companies, it is not advisable to pick stocks only on the basis of their price. Debt is the money a company borrows from outside parties to fund its business. Therefore, companies with low debt have lower interest payouts. This increases profit and gives access to more funds for growth/expansion. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Forbes has put together a list of the best high-growth stocks to invest in for 2023. The information is sourced exclusively from the Bank of America Securities. However, as expected, the listed companies are spread across multiple sectors.

Best Russell 2000 ETFs to Buy in 2023 – The Motley Fool

Best Russell 2000 ETFs to Buy in 2023.

Posted: Wed, 26 Apr 2023 18:23:00 GMT [source]

Therefore, an increasing trend in the net profit margin indicates that the company enjoys good financial health overall. Here are the top 10 stocks under Rs. 100 based on a high net profit margin. Note that zero debt doesn’t mean that the company has no liabilities at all. While debt is what the company owes to third parties, liabilities include accrued wages, accounts payable, income tax, and others. Since ‘credit’ is a way of doing business, a company can rarely be liability-free.